While most of us will gear towards the cheapest personal loan in Singapore when we’re narrowing down our loan options, the loan with the lowest interest rate may not necessarily be the best option for every individual.

When it comes to choosing a loan provider, it pays to consider a range of factors beyond just interest rates, particularly if you aren’t in the best position to obtain loans from traditional banks.

Even though some of the best licensed money lenders in Singapore may not have the lowest rates, it does not mean they should automatically be filtered out of your loan consideration exercise. In fact, for some people, licensed money lenders are their only legal source for getting a loan approved.

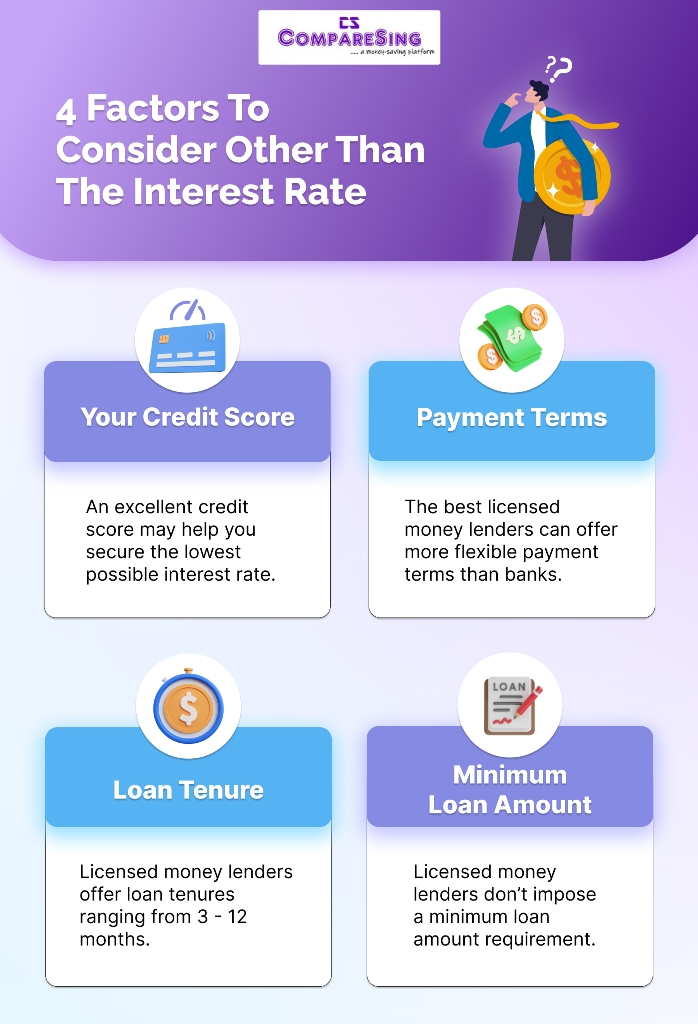

Factors to consider other than the interest rate

#1 Your credit score

A credit score is a numerical value that represents an individual’s creditworthiness depending on their credit reports from the credit bureau. In this report, factors such as past loan applications, the performance of existing loans, the total level of debt, and repayment history are examined.

These components make a difference when applying for a loan — some lenders, in particular major banks, may not accept your application if you have a low or below average credit score. Like it or not, your credit score matters. Your credit score is usually the deciding factor to secure the lowest personal loan interest.

Fret not if your credit score isn’t as high as you’d like it to be. Licensed money lenders can be an alternative option if and when you need to obtain an urgent cash loan.

Some of the best licensed money lenders in Singapore can be quite lenient on applicants with poor credit scores. Applicants may even get an unsecured personal loan that requires no collateral within a day despite their low credit score. However, due to this leniency and the high risk the money lender is taking, even the best credit loan company will charge a higher interest fee for the loan compared to what major banks offer.

The interest rates for a personal loan from a licensed money lender can go up to 4% per month, but nothing higher than that.

Keen on improving or building up your credit score? Pay off your credit card debts in full before their due date. If you have existing loan repayments, pay those off punctually as well. Make sure you do these consistently.

#2 Payment terms

Did you know the best licensed money lenders in Singapore often offer flexible payment terms to their borrowers? For example, instead of paying a fixed sum every month, the borrower can decide how much he wants to pay at the end of each month as long as it’s above the minimum sum. But of course, whatever amount owed will continue to incur interest.

#3 Loan tenure

Major banks in Singapore offer borrowers loan tenures of at least one year while licensed money lenders have much more flexibility in that regard. If you need a quick cash loan to tide you through an emergency and you foresee yourself being able to repay the loan within a couple of months, going to a licensed money lender isn’t a bad idea.

#4 Minimum loan amount

There isn’t any minimum loan amount you are required to borrow when you go the licensed money lender route. On the other hand, banks in Singapore often stipulate that borrowers must borrow at least $1,000 if they would like to take out a loan from the bank.

For people who only need to borrow fairly small sums of money, going to a licensed money lender may be their only option since the banks wouldn’t even entertain their request, regardless of their credit score or credit history.

The best credit loan company for you may not necessarily offer the lowest interest rates

Some of the lowest interest rates for loans come from local banks. However, banks are out of reach for some people due to their own circumstances or needs.

Depending on your personal situation, the best credit loan company for you may actually be a licensed money lender that guarantees you a loan when you need it most, despite the relatively higher interest rates.

Need an urgent loan? Learn how to choose the right licensed money lender, pronto. To start, get loan quotes from the top licensed money lenders in Singapore via CompareSing now! CompareSing works with reputable money lenders across our sunny island to bring you multiple loan quotes minus the hassle.