Understanding Legal Online Licensed Money Lenders (Singapore)

Licensed money lenders are private legal money lenders in Singapore available to people in need of urgent loans. Lawful through and through, these legitimate money lenders (also known as authorised money lenders or registered money lenders) are registered loan companies regulated by the Ministry of Law’s Registry of Moneylenders.

To carry out the business of money lending, a licensed money lender must (i) have a valid money lender licence; (ii) abide by all the rules and regulations set out by MinLaw; (iii) and adhere to the Moneylenders Act.

Quick and reliable money lenders in Singapore aren’t charitable organisations. In exchange for providing fairly accessible loans to borrowers from all walks of life, licensed money lenders charge interest and fees on loans.

Licensed money lenders are private legal money lenders in Singapore available to people in need of urgent loans. Lawful through and through, these legitimate money lenders (also known as authorised money lenders or registered money lenders) are registered loan companies regulated by the Ministry of Law’s Registry of Moneylenders.

To carry out the business of money lending, a licensed money lender must (i) have a valid money lender licence; (ii) abide by all the rules and regulations set out by MinLaw; (iii) and adhere to the Moneylenders Act.

Quick and reliable money lenders in Singapore aren’t charitable organisations. In exchange for providing fairly accessible loans to borrowers from all walks of life, licensed money lenders charge interest and fees on loans.

From the types of loans available to how you can conveniently get multiple loan offers from highly rated, reliable private money lenders in Singapore, here’s a quick overview of borrowing from licensed money lenders in Singapore.

Top 8 Licensed Money Lenders in Singapore

If you find yourself in need of swift, reliable loans. Consider approaching legalised, reliable money lenders in Singapore. The loans are thoroughly legal, just like loans from traditional loan providers such as big banks and financial institutions. In case you didn’t already know, private legal money lenders in Singapore are authorised money lenders regulated by the Ministry of Law’s Registry of Moneylenders.

Blk 709 Ang Mo Kio Ave 8, Ang Mo Kio Central 3, #01-2595,

Singapore 560709

(Ang Mo Kio Central, 4 mins walk from AMK MRT)

11am – 7.30pm Monday – Saturday

(Closed on Sunday, Public Holidays)

Galaxy Credit shines thanks to the diverse specialised personal loans it offers. This Ang Mo Kio money lender caters to a wide range of clientele and fine-tunes its loan conditions to suit every borrower’s specific needs.

Galaxy Credit is committed to offering all customers a quick and easy assessment and approval process. Borrowers will be hard-pressed to find a licensed money lender with a faster loan application-to-cash period.

Blk 846 Yishun Ring Road, #01-3661, Singapore 760846 (Khatib Central, 5 mins walk from Khatib MRT)

11.30am – 7.30pm Monday – Friday

11.30am – 6pm Saturday

(Closed on Sunday, Public Holidays)

6635 1596 (Look For Jacob)

R2D Credit makes our list of legal private money lenders in Singapore for its genuine drive to help customers become debt-free soonest. The Yishun money lender is more than happy to share professional advice that goes a long way in helping customers stay debt-free for the long term.

Placing customers’ satisfaction as a top priority, R2D Credit promises the utmost secure, confidential, and personalised loan experience wholly catered to your needs. For example, R2D Credit is pleased to offer borrowers flexible repayment plans with customisable payment due dates.

1 Park Road, People’s Park Complex, #01-21, Singapore 059108 (Chinatown, 2 mins walk from Chinatown MRT Exit C)

11am – 7.45pm Monday – Saturday

11am – 5pm Sunday

(Closed on Public Holidays)

6226 8860

Having been in business since 1995, Soon Seng Credit prides itself on being transparent, trustworthy, and always offering realistic advice as well as affordable monthly repayments.

The Chinatown money lender is perhaps the most easily accessible licensed money lender in the country thanks to its central location. As a trusted money lender in Singapore, Soon Seng Credit places great emphasis on the borrower-lender relationship. Few other lenders are as focused on ethical lending as this licensed money lender.

210 New Upper Changi Rd, #01-723, Singapore 460210 (Bedok Central, 5 mins walk from Bedok MRT)

11.30am – 7.45pm Monday – Saturday

11.30am – 5.45pm Sunday

(Closed on Public Holidays)

6448 7448

Located on the eastern side of Singapore in Bedok, UK Credit aims to offer customers affordable rates and fair payback terms regardless of whether they are looking at getting a personal loan or business loan.

Great for anyone and everyone in need of urgent cash loans, UK Credit is accessible even to those without a stellar credit history. Another noteworthy service you need to know? The Bedok money lender provides borrowers with a grace period so they wouldn’t have to pay late charges should they need more time to make repayment.

Blk 302 Ubi Ave 1, #01-31, Singapore 400302 (2 mins walk from Ubi Mrt Exit A)

11.30am – 7.30pm Monday – Friday

11.30am – 7pm Saturday

(Closed on Sunday, Public Holidays)

6292 2629 (Look for Clara / Sim)

If customer reviews are representative of what a company is worth in their eyes, 96BM Credit’s 5-star average amongst a whopping 2,700 Google reviews should be a good indicator of its standing as one of the most reliable money lenders in Singapore.

In case you’re wondering, 96BM Credit boasts one of the highest loan approval rates in the industry, which is unsurprising considering that the Ubi money lender does not assess borrowers’ credit scores.

Blk 447 Clementi Avenue 3, #01-201, Singapore 120447 (Clementi central, 5 mins walk from Clementi MRT)

11.30am – 7.45pm Monday – Saturday

11.30am – 4.45pm Sunday

(Closed on Public Holidays)

6250 0066

Regardless of whether you’re a regular consumer, a self-employed individual, or a business owner, Synergy Credit has your urgent cash loan needs covered. The licensed money lender offers:

Nestled in the heart of Clementi, you can rest assured that Synergy Credit is credible. This friendly neighbourhood licensed money lender is committed to maintaining the highest standards of integrity and ethical lending in accordance with all applicable laws established by the Registry of Moneylenders in Singapore.

Vision Exchange, 2 Venture Drive, #01-21, Singapore 608526 (Jurong East Central, 5 mins walk from Jurong East MRT Station Exit B)

11am – 7.30pm Monday – Saturday

12pm – 5pm Sunday

(Closed on Public Holidays)

6493 0088

Keen on engaging the services of a legitimate money lender that promises that you’ll get your loan within 30 minutes? Look no further than Cash Direct, a legal money lender in Jurong East that prioritises their customers’ in-person hospitality experience through and through (think of the VIP waiting and service area, dedicated concierge service, Nespresso coffee, and snacks). Cash Direct lets borrowers gain access to a fully customisable loan that aligns with their needs.

Blk 190 Lorong 6 Toa Payoh, #01-576, Singapore 310190 (Toa Payoh Central, 5 mins walk from Toa Payoh MRT)

11am – 7.30pm Monday – Saturday

11.30am – 5pm Sunday

(Closed on Public Holidays)

6252 0088

1187 Upper Serangoon Road, The Midtown, #01-21, Singapore 533971 (Hougang Central, 5 mins walk from Hougang MRT Station)

11.30am – 8pm Monday – Saturday

11:30am – 5pm Sunday

(Closed on Public Holidays)

6384 0088

The only licensed local money lender in our round-up with two office locations that you can visit at your convenience—Hougang and Toa Payoh.

GoldStar Credit strives to provide unparalleled customer satisfaction with its loan procedures, loan plans, and services. The licensed private money lender in Singapore offers borrowers specially curated repayment plans based on individual needs and requirements.

Table of Contents

Topic

Compare Loan Quotes Easily on CompareSing

While we have gathered our top licensed local money lender picks above for your easy reference, we understand that everyone’s needs and wants are different when it comes to borrowing from licensed money lenders.

The majority of us in urgent need of cash loans would logically want to have a couple of loan quotes on hand to compare, before settling on the one that best suits our needs.

The Moneylenders Act is a set of legislations that seek to regulate the Singapore legal money lending industry. All legalised money lenders in Singapore are required to adhere to all the established legal requirements and guidelines.

The Moneylenders Credit Bureau (MLCB) is a data depository of every single loan application and repayment record with Singapore's authorised licensed money lenders. Legal money lenders in Singapore, borrowers, and the Ministry of Law’s Registry of Moneylenders are the only ones who can access information at the money lender bureau of Singapore.

The money lender bureau of Singapore provides relevant information to registered money lenders to help them make a more informed decision when assessing a borrower’s creditworthiness. The Loan Information Report comprises the summary of a borrower’s active loans as reported by trusted money lenders in Singapore. From the report, authorised money lenders in Singapore can view the borrower’s outstanding payables and payment history.

The Credit Association of Singapore is Singapore’s licensed money lender association. The majority of legitimate money lenders are members of this association.

Apart from representing, developing, and promoting Singapore’s money lending industry, the association also protects the interests of its members and offers training programmes for its licensed money lender members. The licensed money lender association strongly advocates for ethical practices in Singapore’s money lending industry.

How much you can borrow from a licensed private online money lender (i.e., how much a licensed money lender online/ in-person can lend you) depends on your annual income and citizenship.

Singapore Citizens and PRs:

- Up to $3,000 if you earn less than $20,000 a year

- 6x your monthly income if you earn at least $20,000 a year

Foreigners:

- Maximum of $500 if you earn less than $10,000 annually

- Maximum of $3,000 if you earn between $10,000 and $20,000 annually

- 6x your monthly income if you earn at least $20,000 annually

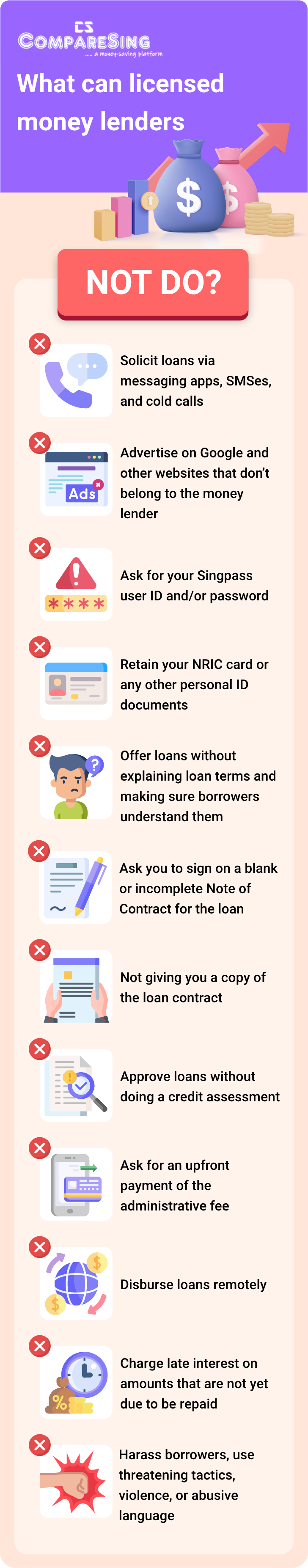

Learn how to spot legal lenders from illegal lenders by paying attention to the nitty gritty details:

- Is the loan offer unsolicited?

- Is the instant money lender in the Registry of Moneylenders’ list of licensed money lenders?

- Is the money lender offering you a loan remotely without doing credit assessments?

- Is the licensed money lender online asking for your Singpass user ID and password?

- What are the quick money lender’s interest rates and fees?

- Is the loan contract empty or incomplete?

The Registry of Moneylenders publishes the complete list of registered money lenders in Singapore on their website. The list is periodically updated on their end.

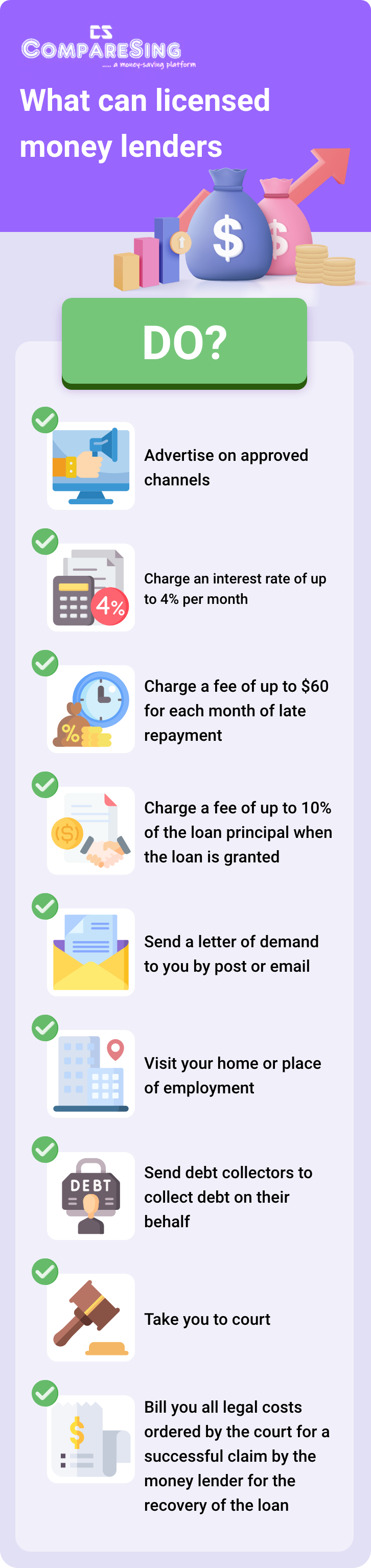

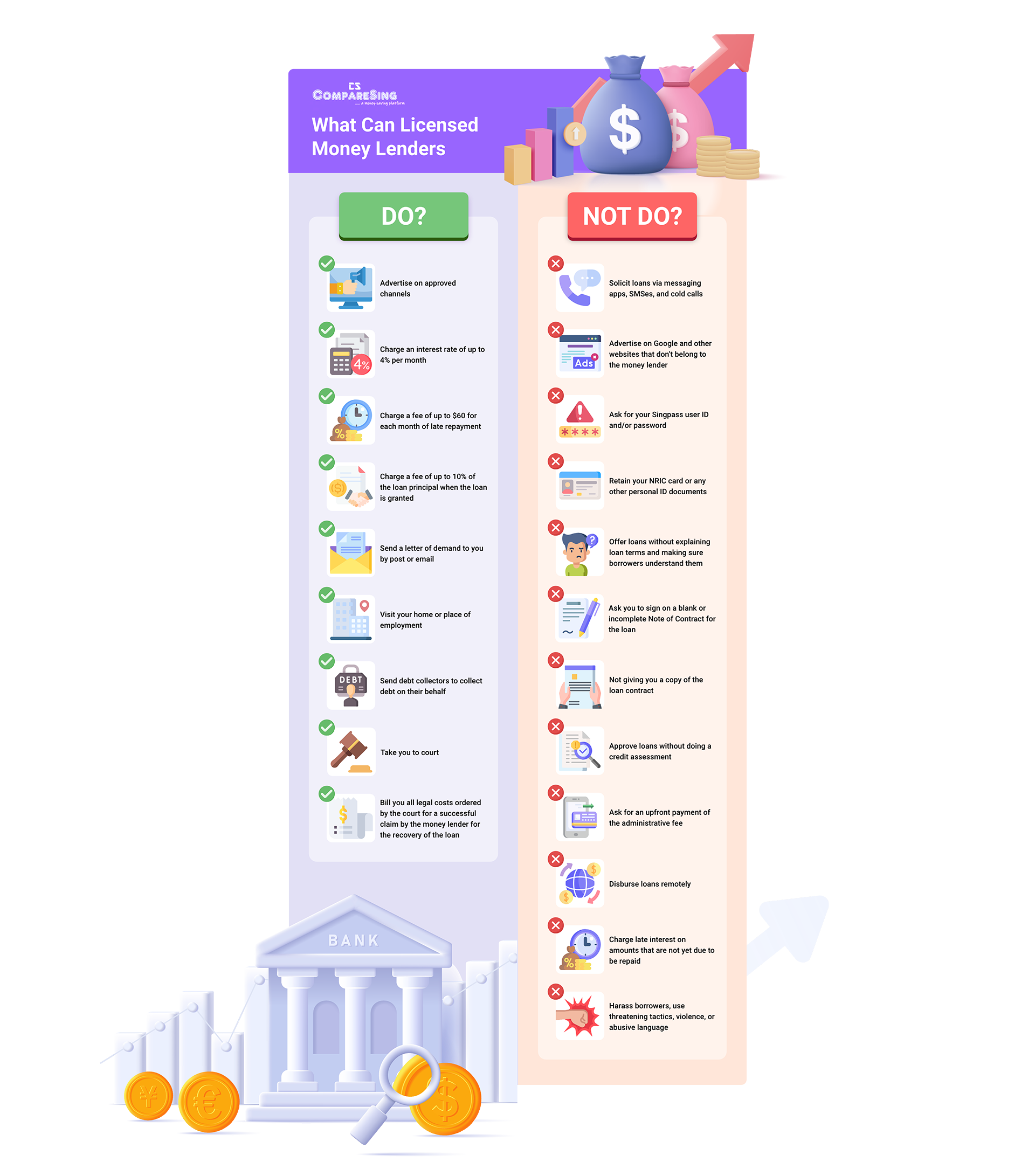

No, legalised money lenders in Singapore cannot advertise their services via SMS, WhatsApp, social media platforms, phone calls, etc.

Borrowing from illegal money lenders or loan sharks can put you and your loved ones’ safety at risk. Not only are they persistently aggressive and exploitative, but the interest charges and fees are also known to be sky-high.

Plus, borrowers certainly don’t enjoy any legal protection—it is illegal to borrow from illegal money lenders in the country. If you need a loan from a money lender, make sure to deal with authorised money lenders in Singapore.

Unfortunately, yes. There have been more and more cases of money lender scams—also known as loan scams—in Singapore.

You should immediately call the Police hotline at 1800-255-0000 or submit the information online. You can also dial the National Crime Prevention Council’s X-Ah Long hotline at 1800-924-5664.

Borrowing From Licensed Online Money Lenders in Singapore

It is safe to borrow from a licensed online money lender in Singapore that lets you submit your application on their website. Foremost, it is legal. Licensed money lenders are not allowed to threaten you with violence, verbally abuse you, or overcharge you in terms of interest on the loan and other charges online and in-person.

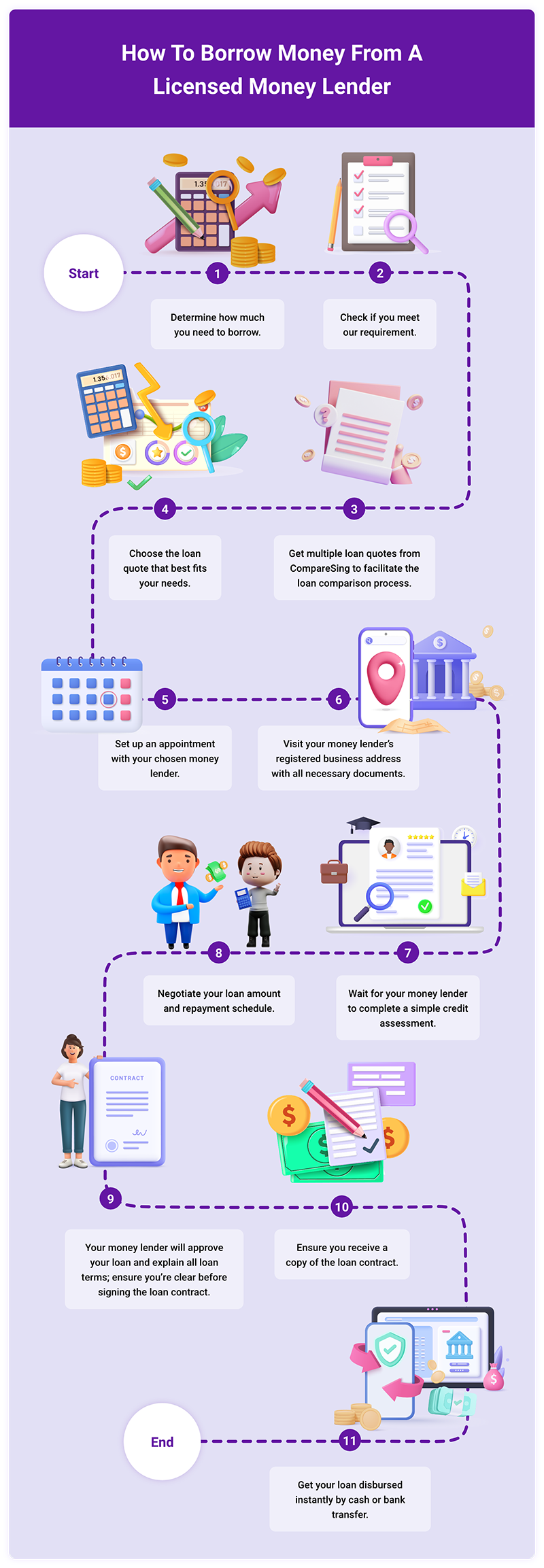

There are important steps to follow before getting a loan from a money lender: Check the legitimacy of a money lender licence by comparing the money lender’s licence number listed in the Registry of Moneylenders’ list of licensed money lenders document against the licence number you see on the displayed money lender licence at the money lender’s office. Their business address and landline number must be the same as the ones listed in the document, too.

Private money lenders in Singapore offer a huge range of loans, such as personal loans, education loans, vacation loans, medical loans, renovation loans, private hire loans, payday loans, debt consolidation loans, business loans, etc.

A debt consolidation loan from a money lender can help you streamline multiple debts quickly while possibly cutting down on the total interest incurred on your debts. It is ideal for you to:

- Use a debt consolidation loan to pay off all your existing unsecured debts

- Make repayments for your debt consolidation loan punctually according to your repayment schedule

By doing so, you only need to focus on making a single repayment to your chosen money lender instead of many separate repayments to several different lenders. Instead of juggling multiple loans, repayment amounts, and due dates, a debt consolidation loan can make it easier for you to keep track of your repayments.

Lawful online instant money lenders like licensed money lenders are allowed to charge up to a monthly interest of 4%. While the interest rates from licensed private lenders are higher than what banks offer, the truth is that not everybody can qualify for bank loans.

Apart from being more accessible, the top legalised money lenders in Singapore may offer those with good credit history, or their regular customers, reduced interest rates among other perks.

In Singapore, interest on a loan from a licensed money lender is calculated using the reducing balance method.

This method calculates interest based on the outstanding principal balance. As you pay down your debt, the amount of interest will also decrease since your outstanding loan balance is decreasing. Take note that the advertised interest rate from a reliable licensed money lender in Singapore is the same as its true, effective interest rate.

Licensed money lenders can charge the following fees:

- a fee not more than $60 for every month of late repayment;

- a fee not more than 10% of the loan principal when a loan is granted; as well as

- Court-ordered legal costs for an effective claim by the licensed money lender to recover the loan

The total charges charged by a legal money lender on a loan, including the interest, late interest, processing, and late repayment fee cannot and should not be more than the principal loan amount originally borrowed.

For instance, if you take a loan of $10,000 from your fast money lender of choice, your interest, late interest, processing fee, and late fee (if any) cannot go beyond $10,000.

Licensed money lenders can only charge late fees of up to $60 for every month of late repayment made.

As for late interest, it can only be charged on the amount that was paid late. The maximum late interest rate a money lender can impose is also 4% monthly for every month the loan is repaid late. Take note that late interest is accumulated daily.

For example, assume you’re taking a loan of $6,000 with a 6-month loan tenure, at an interest rate of 4% per month. If you fail to pay the first instalment of $1,145 before your due date, the licensed money lender can charge the late interest of 4% per month on the $1,145 but not the remaining $5,722 that is not yet due.

Most licensed local money lenders only provide a loan tenure ranging from 1 to 12 months, but some also provide a loan tenure up to 24 months.

The loan amount approved is typically around 1-3 times your monthly income, charged at a 1-4% monthly interest rate. Most of the time, licensed money lenders charge a processing fee of 5-10% of the approved loan amount.

There’s no need for either party to resort to violence to settle any dispute that may arise.

To settle licensed money lender disputes, consider the following options:

- Negotiate a new repayment plan amicably

- Reach out to social service organisations

- File for bankruptcy (last resort)

If a money lender keeps threatening you despite pleas to stop, you should immediately lodge a complaint against your licensed money lender. You can do so by calling the Registry of Moneylenders at 1800-2255-529 or filling up their online form. All errant licensed money lenders will be taken to task.

Quick and reliable licensed money lenders can give you a loan approval online in less than 30 minutes from the time you enquire about the loan (a solid perk offered by fast money lenders). However, you’ll still be required to head down to the money lender’s registered business address for a face-to-face verification before your loan can be disbursed.

Main Differences Between Borrowing From Banks and Money Lenders in Singapore

| Banks | Licensed money lenders | |

|---|---|---|

| Minimum loan amount | $500 - $1000 (depending on the bank) |

N/A |

| Credit checks | Very stringent | Less stringent |

| Loan approval period | Up to 2 weeks | On the same day, usually less than 30 minutes |

| Interest rates | 3.4-6.5% per annum | 1-4% per month |

| Loan tenure | Up to 7 years | Up to 12 months |

| Processing fees | Typically 1-3% of the approved loan amount | Up to 10% of the approved loan amount |

Licensed Money Lender Loan Application Procedures and Requirements

Anyone who fulfils the following criteria can borrow from licensed money lenders:

- Aged 18-65 years old;

- Employed full-time with a monthly CPF contribution OR is able to show proof of consistent income (for self-employed and freelancers);

- Is a Singaporean, PR, or foreigner

For Singaporeans and PRs, you will need to provide your NRIC or passport, Singpass login credentials to verify your monthly CPF contributions, and Notice of Assessment (NOA).

For foreigners, you will need to provide evidence of employment in the form of your employment contract or work permit. You will also need to provide proof of residency and income.

Every authorised money lender in Singapore offers different interest rates and packages. Depending on your income and repayment ability, you may be able to borrow up to as much as 6x of your monthly salary.

No, licensed money lenders do not offer loans with no credit checks. All of them, including quick money lenders, have to assess borrowers’ creditworthiness before extending any loan to them.

That being said, don’t worry if your credit history isn’t the best—there are money lenders for people with bad credit.

Yes, unlike banks, licensed money lenders do offer loans to people with poor credit scores.

Absolutely! Many licensed money lenders provide loans for foreigners in Singapore.

Yes, licensed money lenders do offer loans for the unemployed if they can show proof of consistent income, such as rental income, retirement payouts, or alimony. In the case of student loans, money lenders do extend such loans when students have guarantors backing their loans.

Use CompareSing to obtain multiple loan quotes the hassle-free way from top-rated licensed money lenders in Singapore.

Repaying Your Licensed Money Lender

If you’re unable to pay your money lender, you should be honest with your money lender about your situation and try to negotiate and work out a new repayment plan. Your money lender may even offer you a payment extension.

Several things can happen when you don’t pay your money lender:

- Late interest and compound interest will start accruing on the balances owed

- Late payment fees will start accruing for every late repayment

- Your money lender may take certain actions to get you to repay what you owe

How To Determine Which Money Lender in Singapore Is Best for Your Needs

Consider the following questions to determine which is the best legal money lender in Singapore for yourself, before getting a money lender’s loan:

Q1. How much can you borrow?

Q2. What are the interest rates, fees, and charges?

Q3. Is the repayment schedule suitable for you?

Q4. Is the money lender reliable and trustworthy?

Q5. Is the loan officer courteous and does he/she give clear explanations to your queries?

Q6. Do the money lenders have a lot of real, positive customer reviews and testimonials?

Q7. Is the licensed money lender located near you?

Not everybody is in a position to get a loan from a bank. Your credit history and credit score matter greatly. For those of you who may need to look for an alternative lender, be aware that the best lenders may not have the lowest interests.

That being said, choosing a trusted money lender in Singapore for yourself doesn’t have to be a difficult or stressful task. Here at CompareSing, we provide a one-stop platform for individuals and business owners to compare different loans and loan offers, quickly and easily. If you’re keen on borrowing from licensed money lenders, all you need to do is fill out a simple online form, sit back, and wait — our network of licensed online money lenders in Singapore strives to get back to you in less than 30 minutes.

Regarding Money Lenders in Singapore…

Absolutely, regardless of where you reside, you will be able to find authorised licensed money lenders near you.

Not really. You can use CompareSing’s free service to get loan quotes from quick and reliable licensed money lenders in Singapore.

All you have to do is fill out a simple online form, wait for money lenders to reach out to you with loan quotes, and compare loan offers!

Yes, some licensed money lenders are open for business on Sunday. Here are some for your easy reference:

No, 24-hour online money lenders do not exist—licensed money lenders do not operate their offices 24/7 even though their websites would allow you to fill up online loan application forms or loan enquiry forms round the clock.

Popular Posts